In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

OPIS

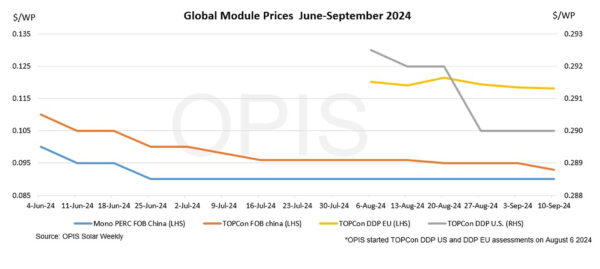

FOB China market

The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China was assessed at $0.093/W Free-On-Board (FOB) China, down $0.002/W week-to-week reflecting buy and sell indications heard. The majority of tradable indications were heard at $0.090-0.095/W FOB China. There were also TOPCon offers at $0.085-0.088/W from the Top 10 module makers circulating in the market.

Market sentiment was bearish. Despite the price pressure from the upstream polysilicon and wafer segment, the overcapacity would curtail any possible price increase in the cell and module segment, an industry source said. The domestic prices of China mono-grade polysilicon gained 1.89% week-to-week at CNY33.625 ($4.74)/kg while mono PERC M10 wafer rose 2.13% at CNY0.144/piece over the same period. Amid intense competition amongst module sellers and pressure to clear inventories, module prices would continue to weaken towards the end of the year, the source added.

The price spread between Mono PERC and TOPCon modules has narrowed due to the reduced supply of Mono PERC modules and the lower production cost of TOPCcon modules. Prices of Mono PERC and TOPCon modules are expected to converge in the coming weeks, an industry source said. OPIS assessed Mono PERC module prices at $0.09/W FOB China in the week to Tuesday.

Europe

In Europe, TOPCon module prices remained stable at €0.107 ($0.118)/W, despite a wider range of indications ranging from a low of €0.090/W and a high of €0.122/W. On the freight side, the Asia-North Europe Ocean freight rates decreased by another 2% to $7,770 per forty-foot equivalent unit (FEU). This corresponds to $0.0184/W.

Market sources do not expect DDP EU prices to change in the near future. Currently, there is abundant production capacity and every manufacturer wants to supply, even at extremely low margins, market players commented.

On the European policy side, the European Commission launched on September 9 its long-awaited competitiveness report. The report calls for a radical change in industrial policies with heightened defensive trade measures and an accelerated legislative process by ending individual nations’ veto powers during council votes.

United States

The spot price for US-delivered duty-paid (DDP) TOPCon modules was unchanged week-on-week. TOPCon module spot price was assessed flat at $0.290/W, and Q1 2025 delivery remained at $0.301/W. Mono PERC Q1 delivery was assessed flat at $0.291/W, and Q2 and Q3 2025 delivery cargoes remain unchanged at $0.294/W.

On the policy front, US trade officials have once again delayed the release of their final determinations in the case of Section 301 tariff hikes, which would see the duties on Chinese solar cells double to 50%, a move seen by some as largely symbolic, as the vast majority of imported solar goods now come from Vietnam, Malaysia, Thailand and Cambodia. Customs and Border Protection has ramped up shipment detainments and not just from Indian manufacturers trying to make inroads in the U.S. market. Maxeon last week reported that all of its shipments from Mexico to the U.S. have been halted since July, with no clear timing on their release.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.