Ethereum (ETH) whales’ recent actions have gathered massive attention from crypto enthusiasts as they dumped a quarter billion worth of ETH in the past 24 hours. This significant dump has raised questions among investors and traders, is the market about to crash or what, why are whales and institutions dumping their ETH holdings?

Whale Sent $257M of ETH Exchanges

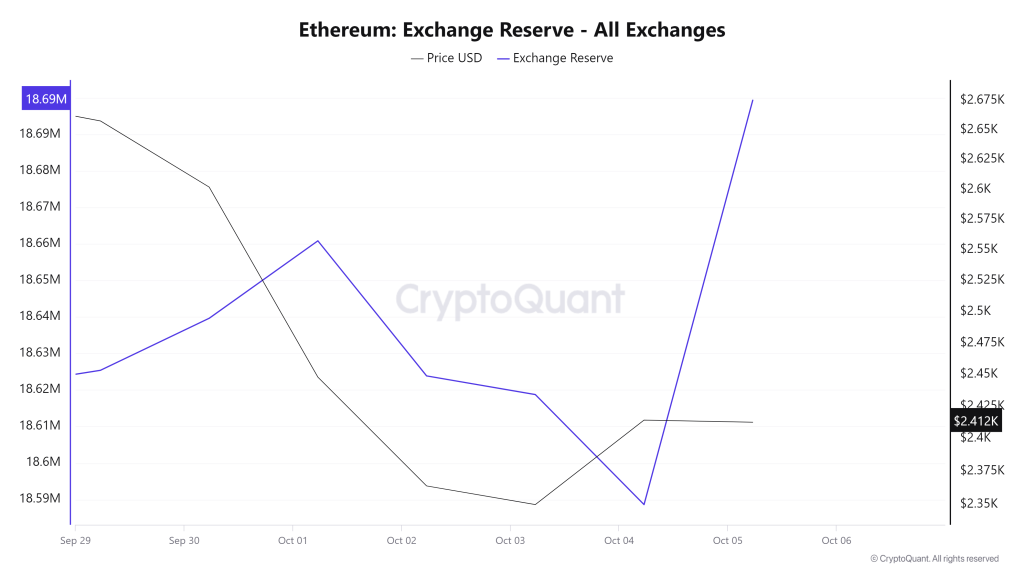

According to an on-chain analytics firm CryptoQuant, Ethereum whales have dumped nearly 107,000 ETH worth $256.8 million to the cryptocurrency exchanges in the past 24 hours. This is a negative sign for the market, whenever the exchange reserve increases it creates selling pressure and causes a massive price decline.

However, these significant dumps occurred when the overall market started to recover on October 5, 2024. Following this dump, ETH hasn’t faced any major price decline.

Ether Current Price Momentum

At press time, it is trading near $2,406 and has experienced a price decline of over 0.75% in the past 24 hours. Meanwhile, its trading volume has dropped by 46% during the same period, indicating lower participation from traders and investors, potentially due to the fear of price decline or market crash.

Ethereum Technical Analysis and Upcoming Levels

According to expert technical analysis, Ether is currently facing strong resistance near the $2,445 level. Following Iran’s strike on Israel, the recent price dip caused ETH to test the support of its ascending trendline. However, it is crucial for ETH to maintain itself above the trendline and the $2,335 level to prevent further price decline.

Based on the historical price momentum, if ETH breaches the trendline and closes a daily candle below the $2,335 level, there is a strong possibility that it could experience a further price decline to the $2,200 level in the coming days.

As of now, ETH is trading below the 200 Exponential Moving Average (EMA) on a daily time frame, indicating a downtrend. The 200 EMA is a technical indicator used to analyze, the asset whether it is in an uptrend or downtrend, and traders and investors make decisions based on that analysis.