Bitcoin is again in a tough zone and the whole crypto market is feeling the heat. BTC price has dropped below a key support level and the fear is spreading in the market. Whales are making waves and diamond hands are staying strong, still the market fails to climb. Let’s dive into what’s happening and what it could mean for Bitcoin.

A Major Drop In Bitcoin Support

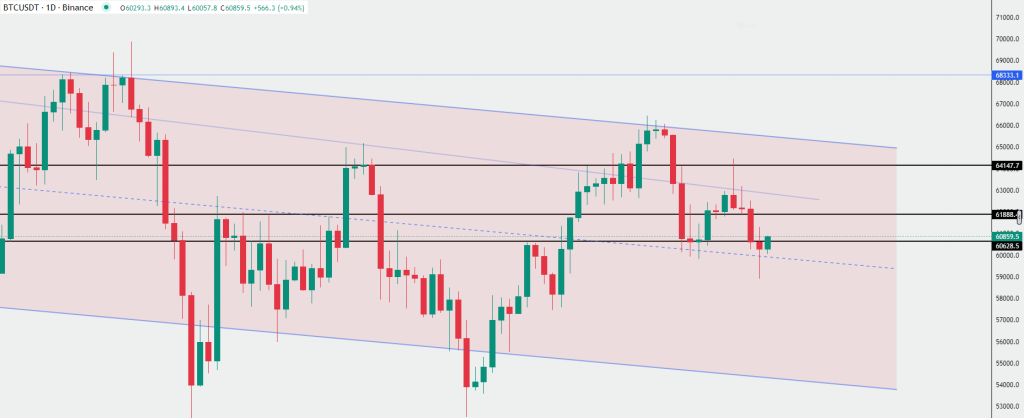

Bitcoin failed to maintain the support at $60,680. The largest crypto has been moving in a parallel channel for over six months now and we have been discussing the risks in our previous articles. At the current level, only the median line is acting as an active support to the price. Making things worse, moving averages (MAs) aren’t providing any support, as all the averages are currently above the price on the daily chart.

The closest MA, which is the 20-day moving average, is actually acting as resistance now, sitting right at $60,680. With an RSI of 45 and a fear and greed index at 32, the market is definitely in a state of fear.

The illiquid supply of bitcoin has reached an all time high means long term holders are not selling anything from their bag. The institutions keep on buying bitcoin. On one side where retail investors and traders are in panic, the whales are taking full advantage of these opportunities.

External Factors Pressuring Bitcoin

Bitcoin’s drop isn’t just because of charts and trends. It’s also feeling pressure from the strong U.S. dollar and confusion over what the Federal Reserve will do next with interest rates. While the Fed did cut rates by 50 basis points last month, they haven’t promised to do it again anytime soon. This has made the market nervous, especially since strong U.S. job data has lowered the chances of another big rate cut in November.

On top of that, inflation in the U.S. was higher than expected. In September, the Consumer Price Index (CPI) went up by 0.2%, which was a bit more than the 0.1% that experts predicted. The Core CPI, which leaves out food and energy prices, rose by 0.3%, again beating forecasts. This combination of economic data has added more uncertainty to the market.

Whale Activity and Market Panic

What’s got the market really shaken up is a few things happening with whales and the U.S. government. Whales are showing no signs of letting Bitcoin rise. There’s a dense cluster of short positions just above the current price, especially around $61,600. These shorts suggest that whales expect the price to drop even further, potentially to around $57,800.

Adding to the panic, the U.S. government is now selling off $4 billion worth of Bitcoin that was seized in the Silk Road case. This massive sell-off has rattled investors and further contributed to the market’s downward trend.

What’s Next?

The crypto market is currently facing a mix of fear, uncertainty, and whale-driven pressure. Bitcoin’s next few moves could determine whether it continues its decline or finds a new support level. Traders and investors should brace for more volatility in the coming days as these factors play out.