Home » Bitcoin » Marathon Digital acquires 6,474 Bitcoin, reveals $160M in cash for future dip purchases

This month has seen a surge of companies entering the Bitcoin acquisition race.

Key Takeaways

- Marathon Digital acquired 6,474 BTC in November and has $160 million in cash reserved for potential future purchases.

- Marathon now holds 34,794 BTC, making it the second-largest corporate Bitcoin holder after MicroStrategy.

Share this article

Marathon Digital (MARA) has added an extra 703 Bitcoin, bringing the total BTC purchased in November to 6,474 BTC, according to a Nov. 27 statement. The firm has set aside $160 million in remaining proceeds to purchase more Bitcoin at a lower cost.

With our 0% $1 billion convertible notes offering, we are excited to share an update:

– Acquired an additional 703 BTC, bringing the total to 6,474 BTC, at an average price of $95,395 per BTC

– YTD BTC Yield Per Share 36.7%

– Total owned BTC: ~34,794 BTC, currently valued at… pic.twitter.com/bzbunlyBRN— MARA (@MARAHoldings) November 27, 2024

The acquisitions came after MARA successfully raised $1 billion through a zero-interest convertible senior note sale. Part of the $980 million net proceeds was used to repurchase a portion of its existing 2026 notes for $200 million, the company said.

The leading Bitcoin miner now holds approximately 34,794 BTC, valued at $3.3 billion at current Bitcoin prices, strengthening its position as the second-largest corporate Bitcoin holder behind MicroStrategy.

Marathon’s holdings represent 0.16% of Bitcoin’s total supply, while MicroStrategy controls 1.8%.

“Bitcoin is definitely something every company should have on its balance sheet,” Marathon CEO Fred Thiel told Yahoo Finance, citing Bitcoin’s finite supply as a hedge against inflation and currency devaluation.

Marathon Digital’s shares closed up nearly 8% on Wednesday, with the stock price rising around 14% year-to-date, per Yahoo Finance data.

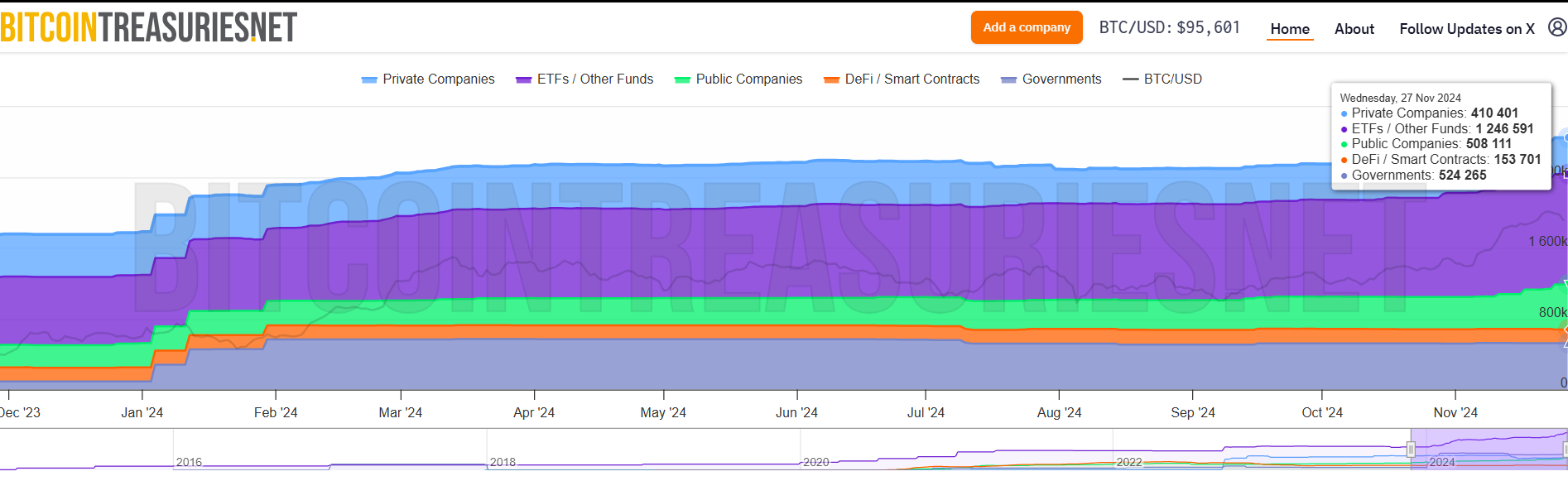

Public companies have increased their Bitcoin holdings from 272,774 BTC to 508,111 BTC year-to-date, with over 143,800 BTC added in November alone, compared to approximately 2,400 BTC in October, according to data from Bitcoin Treasuries.

The growth is largely driven by MicroStrategy’s aggressive buying approach. The firm acquired over 130,000 BTC in November, with its record purchase occurring last week.

A growing number of companies are also adopting a Bitcoin treasury reserve strategy this month.

On Monday, Rumble announced plans to allocate up to $20 million of its excess cash reserves to Bitcoin purchases. The move came briefly after Rumble CEO Chris Pavlovski revealed the idea of adding Bitcoin to Rumble’s balance sheet, which gained support from Michael Saylor.

AI firm Genius Group acquired $14 million worth of Bitcoin earlier in November. The company is committed to holding 90% or more of its reserves in Bitcoin, with a target of reaching $120 million in total Bitcoin investments.

Share this article