ASX: IAG Elliott Elliott Wave technical analysis

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with INSURANCE AUSTRALIA GROUP LIMITED – IAG. We see ASX:IAG possibly continuing to push lower with wave ((4))-navy in the coming period.

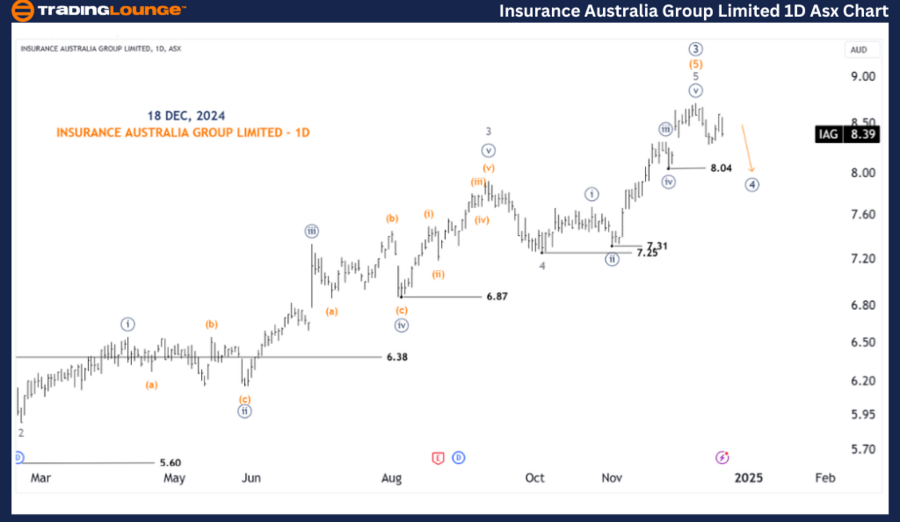

ASX: IAG one-day chart (semilog scale) analysis

Function: Major trend (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Wave ((4))-navy.

Details: Wave ((3))-navy has most likely ended as a five-wave as I counted from (1)-orange to (5)-orange. So wave ((4))-navy is likely pushing lower, and will target around the 7.25 low. While price must remain below the 8.60 high to maintain this view.

Invalidation point: 8.60.

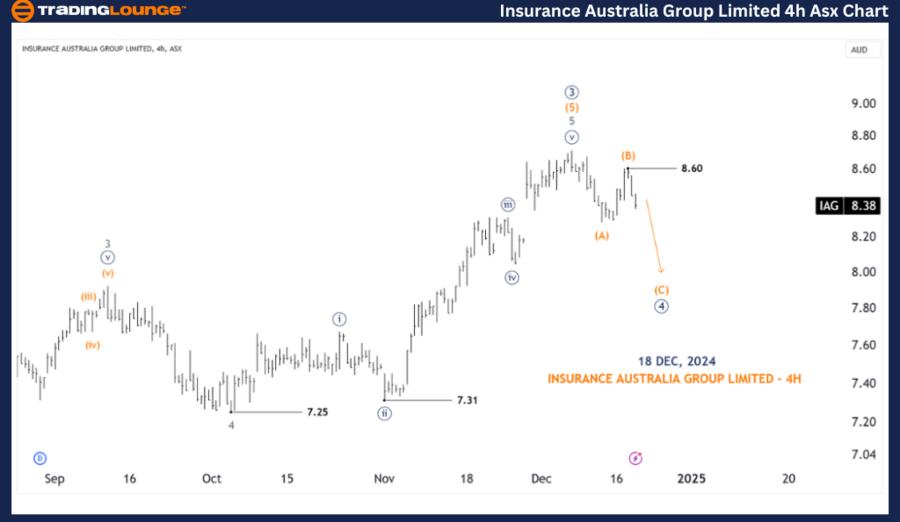

ASX: IAG four-hour chart analysis

Function: Major trend (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Wave (C)-orange of Wave ((4))-navy.

Details: Looking closer, the ((4))-navy wave is developing as a Zigzag labeled (A)(B)(C)-orange or it can also be replaced with (1)(2)(3)-orange, it doesn’t matter, as the price action will probably continue to push lower.

Invalidation point: 8.60.

Conclusion

Our analysis, forecast of contextual trends, and short-term outlook for ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

Insurance Australia Group Limited analysis and Elliott Wave forecast [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

![Insurance Australia Group Limited analysis and Elliott Wave forecast [Video]](https://www.newsflashtom.club/wp-content/uploads/2024/12/17522-insurance-australia-group-limited-analysis-and-elliott-wave-forecast-video.jpg)