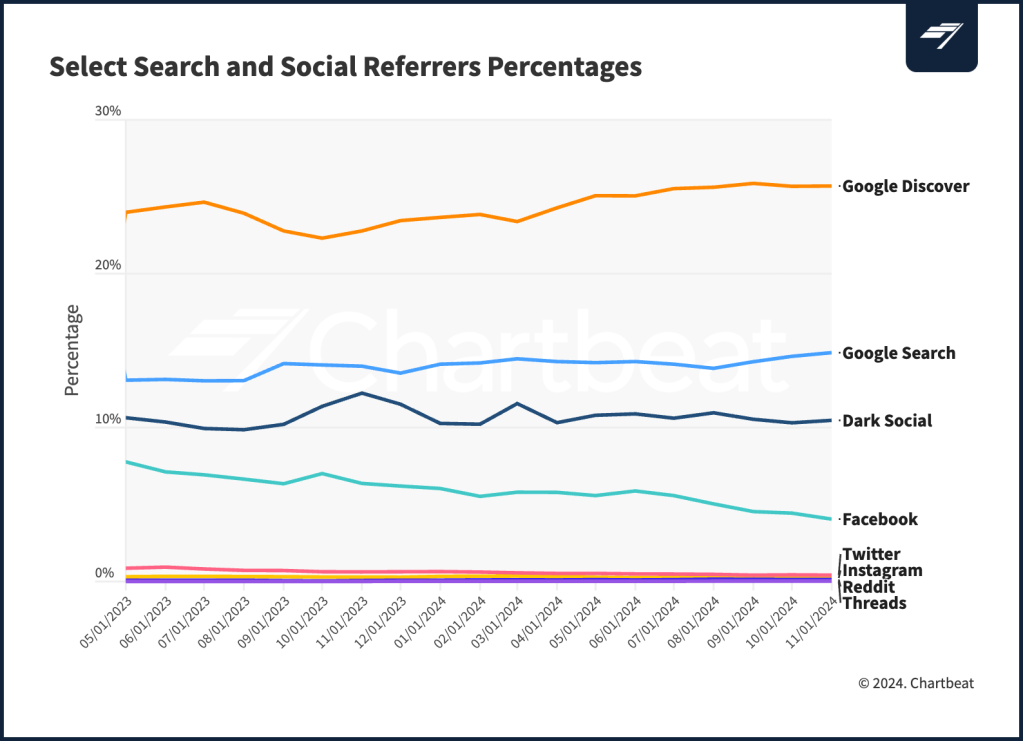

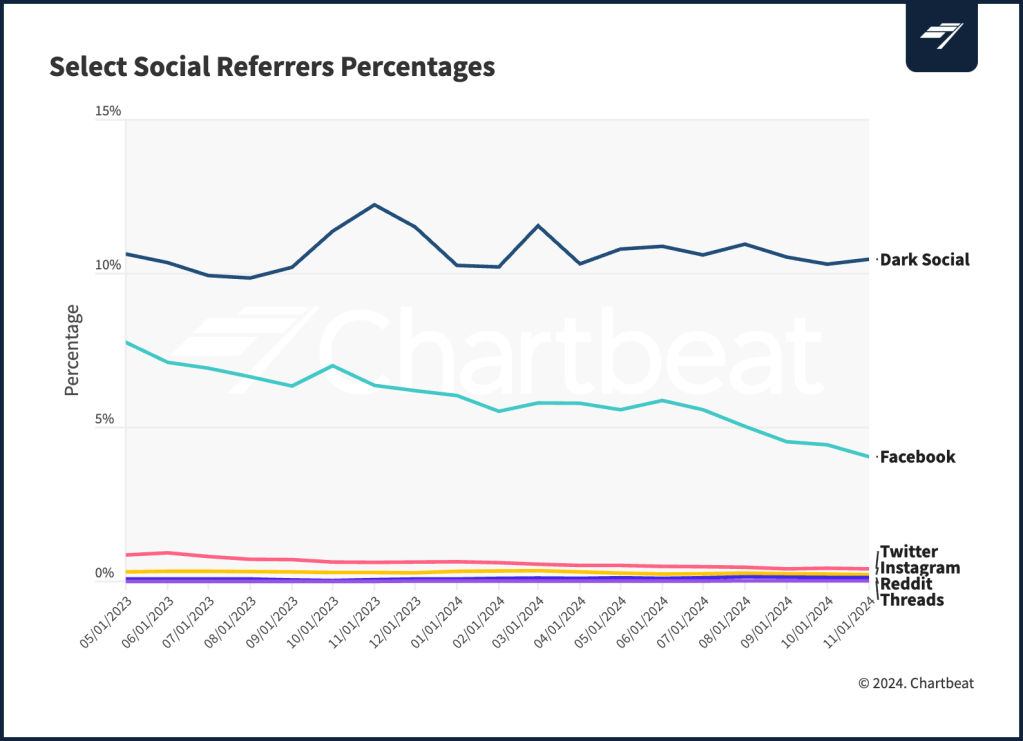

The fragmented social landscape continued to splinter in 2024, as traffic from social media platforms sent to publishers’ sites continued its steady decline this year.

The bright spot? Largely Google. Publishers saw increases in traffic from Google Discover — and Google Search’s generative AI feature hasn’t had a negative impact on the traffic to publishers’ sites.

Other than Facebook, social platforms like Instagram, Reddit and Threads are all driving marginal traffic to publishers’ sites, according to Chartbeat’s data from about 3,750 sites.

While that wouldn’t surprise anyone given publishers have seen referral traffic from social media platforms trend down for a few years now, it does put into perspective the efforts publishers have put into trying to build audiences on newer platforms like Bluesky and Threads. Publishers are looking for new spaces to distribute their content and see if they can drive audiences back to the site, while also not wanting to spend too much of their limited resources on these efforts as it still remains unclear how big of a role they will have in their audience development goals.

Here’s how referral traffic has changed from November 2023 to November 2024 for 3,750 sites, according to data from publisher analytics firm Chartbeat:

- Direct traffic declined from a 23% share of overall traffic to publishers’ sites to a 20% share year over year.

- Google Discover traffic increased from a 22.8% share to a 25.7% share.

- Google Search increased slightly from a 14% share to a 14.9% share.

- Bing traffic also increased marginally from 0.5% to 0.6%.

- Google News declined slightly from a 1.7% share to a 1.5% share.

- Facebook traffic declined from a 6.4% share to a 4% share.

- X traffic declined from a 0.6% share to a 0.4% share.

- Yahoo Search, Instagram, Pinterest, Reddit, Threads, YouTube and LinkedIn stayed about the same. All sent a marginal share (less than 0.5%) of traffic to publishers’ sites.

(Note on the chart: Chartbeat made a change in how it measured traffic from Google, breaking out Google Search and Google Discover in May 2023)

Since OpenAI’s ChatGPT launched in November 2022, publishers have said they are concerned that the generative AI chatbot’s ability to quickly summarize information in response to users’ questions could lead to a decline in the referral traffic publishers get from search results. OpenAI has since signed a number of content licensing deals with publishers that include attribution and links to publishers’ sites — while others like The New York Times have chosen to pursue legal action against OpenAI, citing copyright infringement.

But three publishing executives — who exchanged anonymity for candor — told Digiday they had not seen notable traffic from AI platforms like ChatGPT or Perplexity.

Let’s dive deeper into traffic referral channels and how they’ve evolved this year:

Google Discover

During the Digiday Publishing Summit in March, multiple publishers said they had anecdotally seen spikes in referral traffic from Google Discover.

Josh Awtry, svp of audience development at Newsweek, told Digiday that Google Discover drives more traffic than Google Search or News.

“There are many days where the majority of [Newsweek’s] audience comes to us from Google Discover,” Awtry said, without sharing more specific audience data.

That’s the case for Reach plc, too. Martin Little, audience director of distribution at Reach, said onstage during the Digiday Publishing Summit Europe in October that Google Discover was overtaking Google Search as a referral traffic source. About 60% to 70% of traffic from Google was coming from Discover.

Sarah Marshall, Condé Nast’s vp of audience strategy, told Digiday in April that Google Discover traffic was up “massively” for the company compared to last year, though she didn’t share specific figures.

But publishers have had to do some work to get there. Condé Nast migrated its sites off Google AMP over the course of 2023 and optimized its own sites (by improving site speed and performance) to get its pages picked up by Google Discover.

Reach plc has tweaked headlines for Google Discover to highlight the most interesting parts of the story (as opposed to trending keywords for Google Search). Both Awtry and Little said Google Discover tends to favor softer, more lifestyle-focused content — so harder news content from Newsweek, for example, isn’t a natural fit for the platform’s algorithm.

Google Search

Updates to Google’s search algorithm this year and the rollout of Google’s AI search feature, AI Overviews, have challenged publishers’ search traffic.

Little said onstage at the Digiday Publishing Summit Europe that Reach’s traffic from Google Search was down 25% in September year over year.

However, Chartbeat’s data shows an increase in the share of Google Search traffic going to publishers’ sites year over year.

Publishers were worried that the rollout of AI Overviews — a feature that provides generated summaries of information from multiple sources to answer a user’s search query — would further deteriorate traffic from the platform. But that doesn’t seem to have materialized — at least not in the aggregate.

AI Overviews “has not led to the drastic changes many in the industry feared, at least in the short term,” according to a spokesperson from web publishing tech provider Automattic.

Data from “thousands” of Automattic’s publisher clients shows an 8% increase in Google referral traffic (however, a spokesperson noted that this figure includes Google Discover, Google News and Google Search traffic).

In his third quarter letter to shareholders, IAC CEO Joey Levin also said the company, which owns Dotdash Meredith, had not seen a notable change in referral traffic due to the introduction of AI Overviews.

“We continue to track the impact of Google’s AI Overviews on engagement and saw no significant changes: AI answers appeared in roughly 20% of DDM’s relevant searches in the quarter and the impact on overall traffic remained minimal, but we remain vigilant on protecting our intellectual property,” Levin wrote.

(Note on the chart: “Dark social” — also called Direct Social or Email, Apps, & IMs — represents the group of visitors who arrived via emails, apps, IMs or other platforms and webpages that do not permit the transfer of referrer data to the site, according to Chartbeat.)

In the spring, Wesley Bonner, head of social and audience development at BDG, told Digiday that Facebook was one of the largest onsite traffic drivers for the company’s sites, accounting for 18% of overall traffic in February.

But by November, Bonner said the publisher had to “unbuckle ourselves from having traffic be the primary KPI” on the platform.

Facebook referral traffic to Automattic’s clients’ sites dropped from 14% to 6% of total traffic since early 2023, according to the company’s data.

Meta has sent a number of signals to publishing execs that it’s not prioritizing traffic referrals. Late last year, Facebook sunset Instant Articles, a feature that loaded publishers’ news articles quickly on the Facebook app, and its head of news partnerships Campbell Brown left the company.

Meta’s decided last month to make “views” the main metric used to measure how all content is performing on both Facebook and Instagram — another sign that the company is focusing on how many people are engaging with content on the platform and not how many people are clicking off of it, publishing execs told Digiday at the time.

The percentage of Facebook-referred traffic (as a percent of total traffic) declined for Automattic’s publisher clients from a high of 14% in spring 2023 to about 6% in August 20224, according to data from the company.

Instagram has never been a notable traffic driver for publishers, so it’s no surprise that it accounted for just a 0.22% share of publishers’ overall traffic in November, roughly flat year over year, according to Chartbeat’s data. And Threads, another Meta platform, drove an even tinier amount of traffic — a 0.02% share. Earlier this year, publishers were experimenting with different types of content shared in posts on Threads to see what stuck with their audiences, but refraining from pouring too many resources into the platform until it proved to be worth it. Three heads of social told Digiday last month that they still haven’t made changes to those efforts.

Bluesky

Bluesky, often seen as an alternative to X, has been the new social platform on the block, drawing a recent surge of new users and publishers. The Boston Globe has already seen more referral traffic from Bluesky than from Threads.

But the platform is so new — and the traffic coming from it so small (about 0.017% of social traffic referrals in November, according to Chartbeat data) — that publishers have yet to figure out a strategy for Bluesky or what role it’ll play in their audience development efforts.

Bluesky referral traffic equaled about 0.8% of X’s referral traffic to publishers, according to Chartbeat.

X

Speaking of X, the platform accounted for 2.6% of social referrals to publishers in November, according to Chartbeat.

Referrals from X dropped by almost half from spring 2023 to August 2024, according to Automattic’s data — driving just 0.6% of traffic.

The role of X has declined amongst some publishers. The Guardian announced it was leaving the platform last month, joining NPR, The Dodo and Polygon in their exodus last year.

But those publishers are anomalies. Over a dozen major publishers told Digiday that X still played a role in their audience development and content distribution strategies — and that though the referral traffic coming from the platform was small, it was notable enough to stay active there.