It looks like the problems for BTC are in no mood to take retirement. First, Germany sold over $3 billion worth of Bitcoin. The market filled with too much fear, causing the BTC price to touch $53,000. Once the sell-off was complete, we are now facing Mt. Gox repayments.

The German Dread

The German government seized around 50,000 BTC from a movie piracy website that was active since late 2013. The government decided to sell them off to the market. Tron founder Justin Sun offered to buy those Bitcoins, but the German government denied the offer. They started selling BTC, which had a great impact on the market, sending it to a ground level of $53,000. Once the sell-off was complete, the market slowly started to rise again. However, another fear hung like a sword over our heads: the Mt. Gox repayments.

A Decade-Old Bitcoin Investment

On June 24 this year, the trustee appointed by the court for Mt. Gox handling announced that they are ready for the repayment. Mt. Gox went bankrupt in 2014, and since then, the investors have been waiting to get their investment back. After a decade of waiting, they are finally receiving it multiplied hundreds of times.

This repayment process is also a great danger for the BTC price. With great efforts, the price of Bitcoin had reached $68,000, but the BTC movement from Mt. Gox plummeted the price again. According to Arkham, Mt. Gox moved BTC worth $2.85 billion to one of their wallets from a cold wallet. This BTC will be sent to four separate Bitstamp addresses to be then delivered to investors. No other thing can better describe this condition than the Bitcoin chart.

Bitcoin crashing on Charts

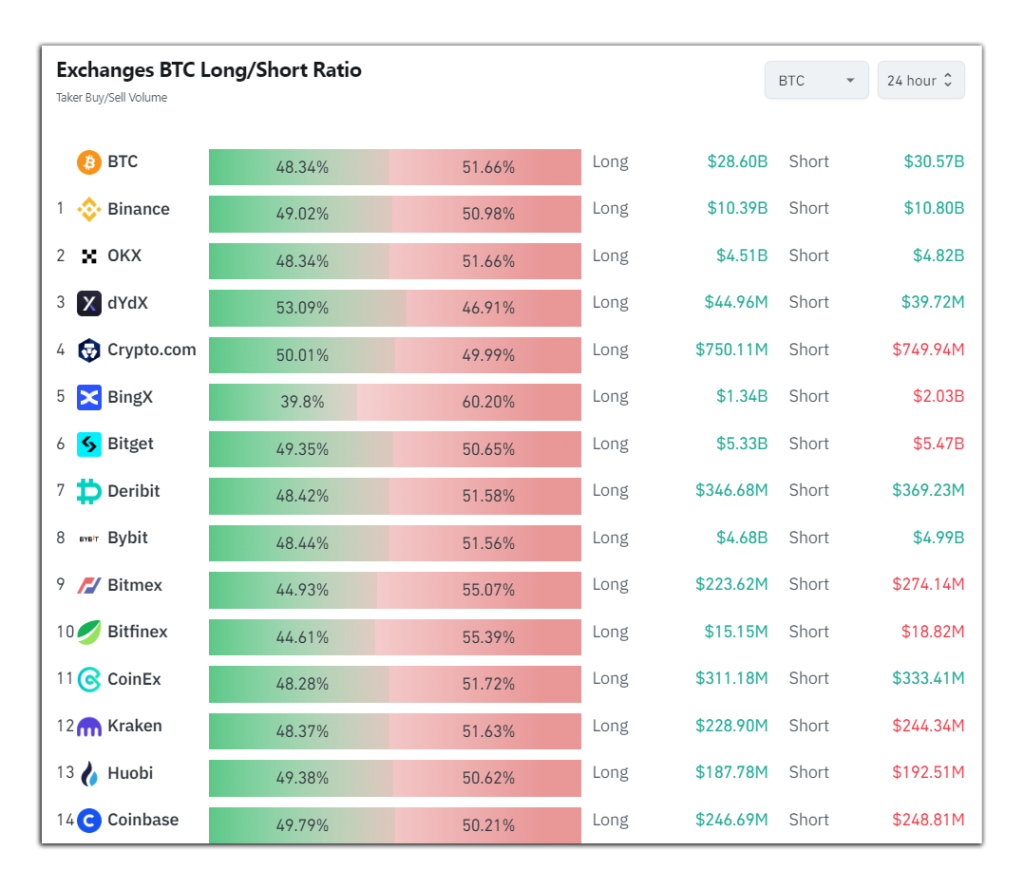

The chart of Bitcoin has filled with a lot of red due to the reasons we have discussed earlier. Coinglass data shows traders are bearish on BTC, with more shorts opened in the last 24 hours. This symbolizes that traders have very low confidence in the rise of BTC price, and this is true to a large extent. Traders liquidated over $200 million worth of trades, both shorts and longs, in the last 8 hours.

The price has fallen below the three MAs: 20, 50, and 100, and is only getting support from MA200. An upcoming death cross between MA 20 and MA100 can be seen. If this happens, MA 200 won’t be able to handle the bearish pressure, and the price will fall to $65,400, which is a slight support.

If this support fails to handle the pressure, there are high chances BTC will fall to a high support zone of $63,000. Right now, the price is hanging between the 0.786 Fib level and MA 200 on an hourly chart. It has a long way to reclaim its position at $68,000. We are seeing a mini bear market during the bull market, which is a highly fearful time as well as an opportunity.

Also Read : Bitcoin Cash Price Prediction 2024 – 2030: Is Bitcoin Cash The Best Investment for 2024?